Southeast Asia has garnered attention as a rapidly developing region with significant potential in the pharmaceutical and life sciences market. The region is often referred to as a “pharmerging” market due to its growing need for pharmaceutical products and it is making substantial strides. In this article we will be joined by our partners No deviation to provide commentary, insights and dive into the factors driving growth in this sector and the opportunities they present for both international and local stakeholders.

Southeast Asia’s burgeoning pharmaceutical market has been buoyed by strong and robust government initiatives that are aimed to expand healthcare access and provide a better quality of life for its citizens. There is growing yet unsaturated demand for pharmaceutical products with lots of new attention from the major players who recognise the huge untapped potential. This is driven by a myriad of factors ranging from ageing populations, rapidly growing welfare and increased citizen expectations which raises demand. The largest established markets like the US and Japan face slowing growth due to pricing pressures, patent issues and regulation and increasingly there are opportunities for growth in Southeast Asia.

The pharmaceutical market in countries like Indonesia, Thailand, China, Singapore, and South Korea is experiencing rapid growth due to the combined impact of an aging population and advances in drug discovery, particularly in monoclonal antibodies and biosimilars. With these countries facing increasing numbers of elderly citizens, demand for chronic disease treatments—such as for diabetes, cardiovascular diseases, and cancer—continues to rise. Furthermore, breakthroughs in biopharmaceuticals are fueling market growth as monoclonal antibodies and biosimilars become more prevalent, allowing for targeted therapies that address complex health issues. Additionally, the rising disposable incomes in these regions are enhancing the ability to afford quality healthcare, thereby accelerating the adoption of both innovative and essential medicines.

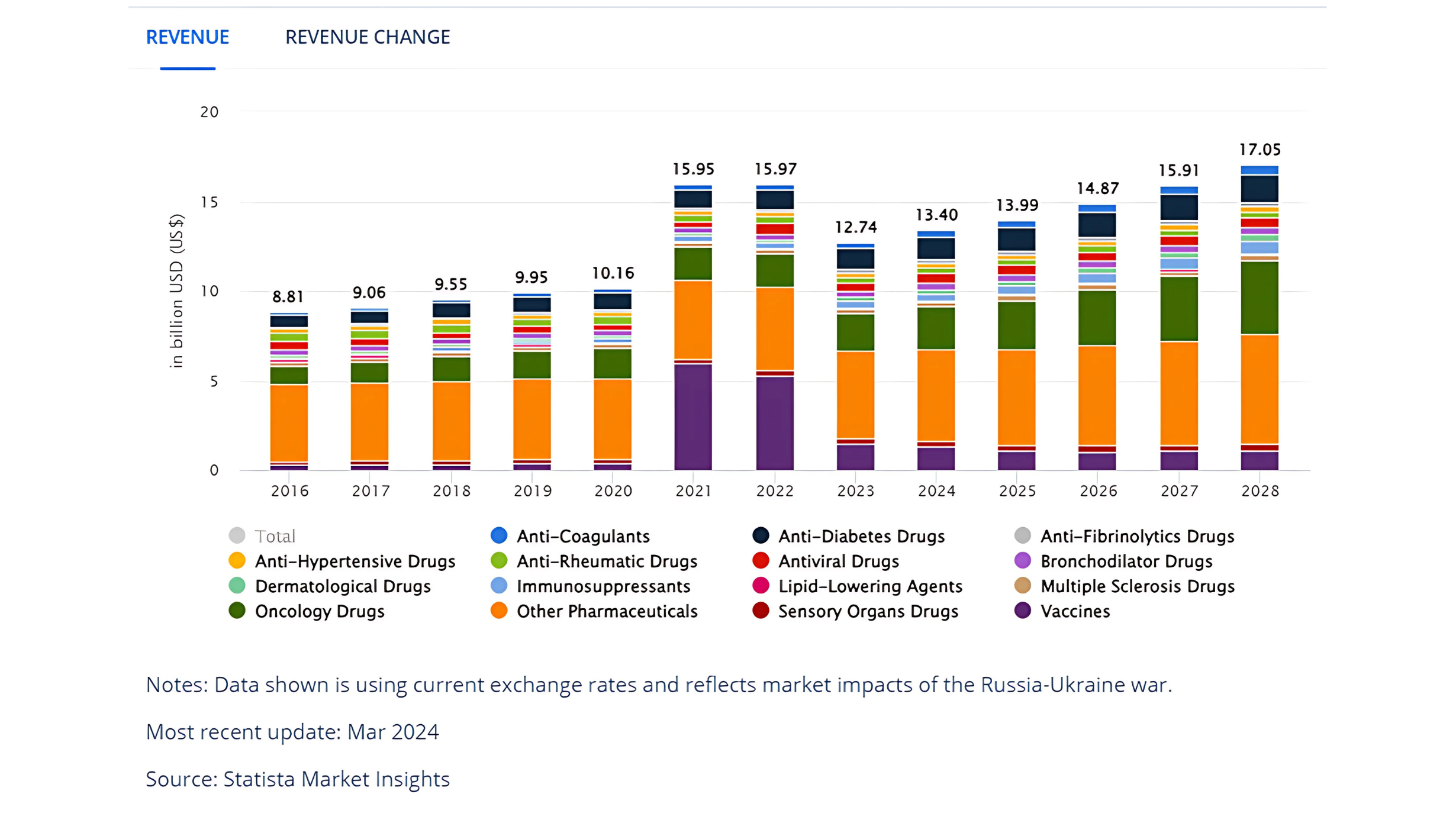

According to Market Research Institute International, the predicted average annual compound growth of the pharmaceutical market from 2023 to 2027 in emerging countries represented by Southeast Asian countries will remain at 5% – 8%, which is higher than the 2.5%-5.5% in developed markets. Also in 2024, the projected revenue is expected to reach US$14.29bn. The Southeast Asian market has undoubtedly the greatest potential for global pharmaceutical development in the future.

From an on the ground perspective, No deviation’s CEO & Founder, Pierre Winnepenninckx said

Based in Singapore, No Deviation has witnessed an acceleration in the construction of manufacturing capacity, largely driven by the harmonization of the PIC/S GMP standards, which grants member countries broader access to high-tier markets like Europe and the US. This regulatory alignment benefits countries like Singapore, South Korea, Indonesia, and Australia, with China soon to follow, as they expand market access and position themselves competitively.

Furthermore, the need to serve local markets, manage costs, and diversify supply chains to enhance geopolitical and natural resilience has fueled this growth. Over the past five years, the industry has not only seen capacity expansion projects but also increased investment in the development of new drugs, underscoring the sector’s strategic importance and adaptability.”

Similarly EIDA’s CEO, Dan McAlister said

We’re witnessing a significant surge in the construction of new pharmaceutical facilities, with many projects either underway or in the planning stages, along with substantial upcoming investments. The outlook for the region is very positive in the short, medium, and long term, and all the right factors are in place for a major boom. Government initiatives, minimal barriers to business, and a concentration of leading companies make this an incredibly exciting time.”

Singapore is the country that stands out in Southeast Asia for its highly developed pharmaceutical market. Unlike its close neighbours, Singapore is not classified as pharmerging but is recognised as a global biopharma hub. It attracts substantial foreign investments and serves as a research, development, and manufacturing base for top international pharmaceutical giants such as Pfizer, Novartis, and AbbVie.

A lot of this success can be attributed to the Singaporean government’s Biomedical Sciences (BMS) initiative. This launched in 2000 and included massive funding and the creation of Biopolis which is a major R&D centre. Singapore maintains a positive trade balance in pharmaceutical products, highlighting its role as a key exporter and emphasising the rest of the region’s reliance on pharmaceutical imports.

Other neighbouring countries have been watching this success like the Philippines, Thailand, and Indonesia and have made substantial strides of their own in reducing household out-of-pocket healthcare expenses and expanding healthcare access. For example if you look at the Philippines, they have seen a decline in household health expenditures since 2014, and is further bolstered following the 2019 Universal Healthcare Act which came in response to the pandemic.

Similarly, Thailand’s Universal Coverage Scheme (UCS) budget has hit its peak so far in 2024, and Indonesia’s national health insurance scheme now covers over 90% of the population, which benefits more than 248 million people.

In terms of regulatory harmonisation, the ASEAN Pharmaceutical Regulatory Policy (APRP) adopted in 2022 aims to integrate the region’s pharmaceutical market by harmonising regulations and safety standards. This is expected to encourage and facilitate market entry for international companies and streamline approval processes for local businesses.

Pharma companies are now looking at various paths to growth with the most common being an expansion into new products, categories or markets. Another strategy involves conducting more research to secure faster approval of new/ innovative products and a somewhat diverging strategy in increasing focus on generics for low-income markets in ASEAN.

Despite challenges in procuring essential raw materials, exacerbated by the war in Ukraine, the pharmaceutical and life sciences sectors are rapidly emerging as key drivers of economic growth across the region’s healthcare and manufacturing industries. There is significant potential for sustained growth, as evidenced by recent billion-dollar investments from major players like Pfizer, AstraZeneca, WuXi, and Samsung, alongside the rise of new entrants in the Contract Development and Manufacturing Organization (CDMO) space, with Lotte Biologic standing out as a particularly promising player. These developments underscore the robust future outlook for the pharmaceutical industry in the region.

Digitalisation:

As the number of projects and investments in the pharmaceutical sector grows, the speed to market for these large-scale projects has become a critical consideration. No Deviation and EIDA are uniquely positioned to deploy specialised knowledge and digital solutions that streamline project execution, enhancing not only efficiency but also the effectiveness of resource management. By focusing on quality, value-added tasks, these solutions enable faster and more reliable project completion, ultimately supporting quicker product launches and better resource utilisation.